Products & Technologies

Back to Menu

Products & Technologies

Services

Resources

Posted

June 26, 2024

Stay updated on our content.

Wafer Fab Equipment Positioned for a New Wave of Growth

By Sundeep Bajikar

June 26, 2024

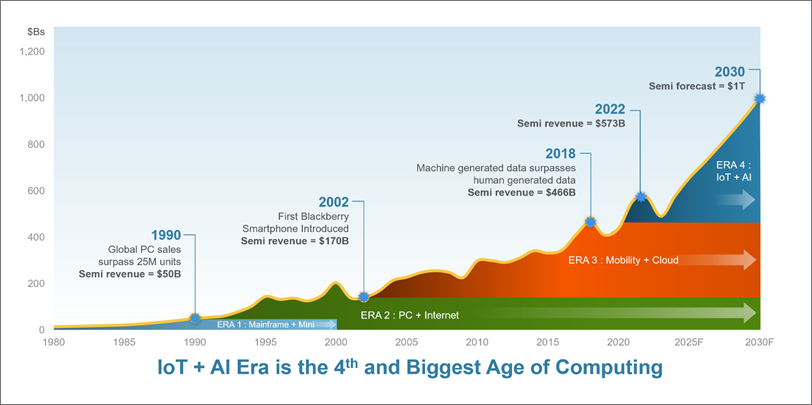

At Applied Materials’ 2021 investor meeting, we suggested that the semiconductor industry had transitioned into a fourth major era of computing. This new “IoT + AI” era began in 2018, when machines generated more data than humans for the first time, complementing the markets for PCs and smartphones that defined the second and third computing eras. Each era creates a new wave of growth by effectively doubling the size of the industry, putting us on track to reach $1 trillion by the end of the decade, as suggested by multiple third-party forecasts.

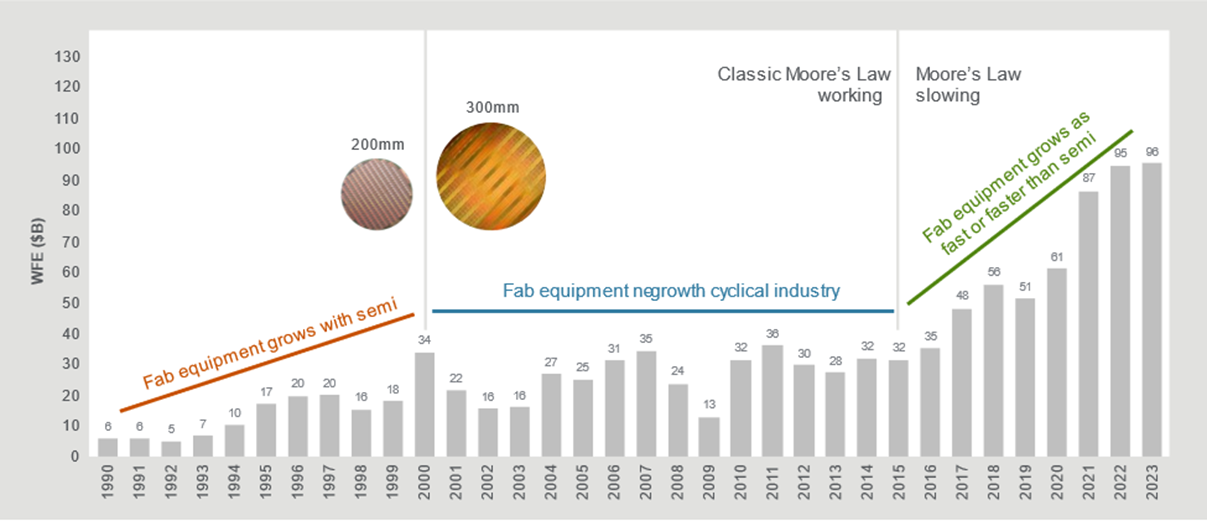

While the semiconductor industry has experienced relatively steady cyclical growth during each of these eras, the same cannot be said of the wafer fab equipment (WFE) sector. From 1990 through 2000, the equipment industry tracked the semiconductor industry. However, beginning in 2000 – marking the transition to larger 300mm wafers – equipment became a no-growth, cyclical industry.

Flash forward to 2015, and we were all pleasantly surprised when WFE broke out of this pattern, once again growing with the semiconductor industry – and at times even faster.

Wafer Fab Equipment (WFE) Spending. Source: Gartner, TechInsights, Applied Materials - SMI.

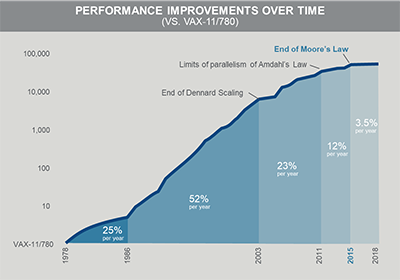

What caused this inflection in growth? When I was a student of computer architecture in the 1990s, my classmates and I relied on the second edition of a textbook by Professors David Patterson and John Hennessy. This classic text described how to make computers run faster and better, with Moore’s Law as a focal point. For most of the industry’s history, the number of transistors on a microprocessor doubled about every two years and drove simultaneous improvements in performance, power and cost. In 2017, Patterson and Hennessy released the sixth edition of their book, in which they declared that Moore’s Law as we know it had ended in around 2015.

Source: Computer Architecture: A Quantitative Approach, Sixth Edition, John Hennessy and David Patterson, December 2017

The slowdown in classic Moore’s Law 2D scaling has been an important contributor to the positive inflection in WFE growth. Today, transistors are shrinking at a slower rate and the industry has needed to adapt. Improving performance and power increasingly requires new processor architectures, more process steps, larger die sizes, new transistors and wiring, and heterogeneous chiplet integration with advanced packaging. These changes are heavily reliant on materials engineering techniques.

But one question is on everyone’s mind: Can this growth be sustained?

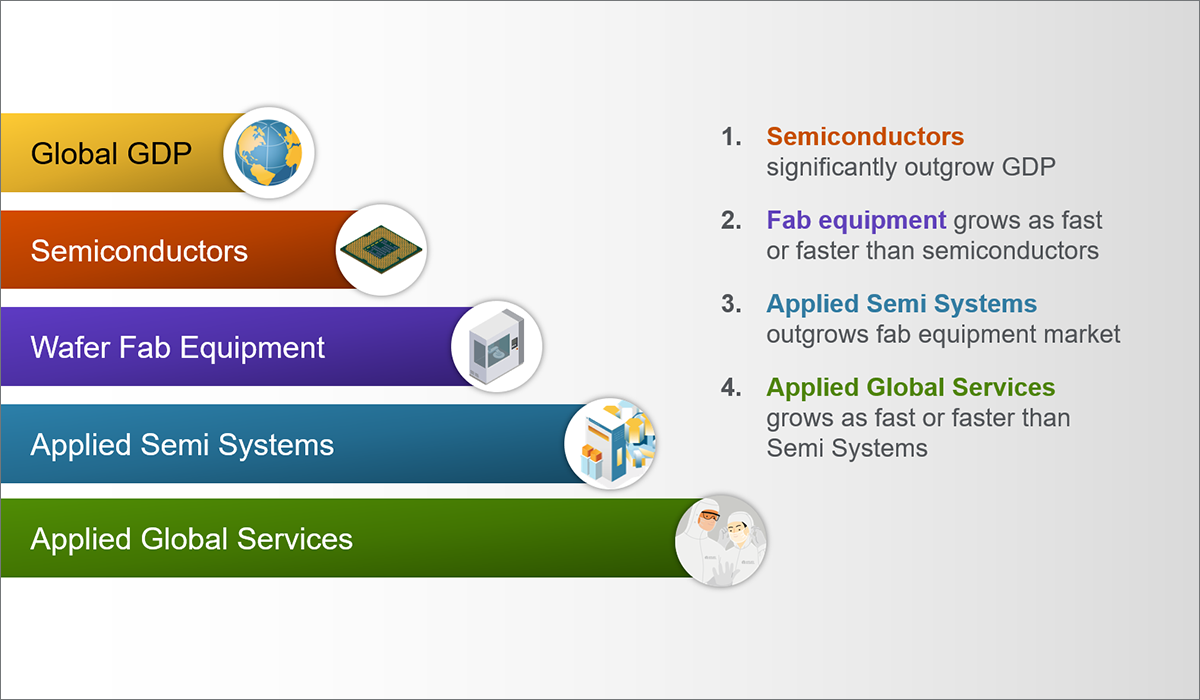

At Applied, we believe the equipment industry can continue to grow as fast or faster than the semiconductor industry on a through-cycle basis. On recent earnings calls, we have shared our growth thesis, which has four pillars:

- We expect semiconductors to outgrow GDP.

- We expect WFE to grow as fast or faster than semiconductors on a through-cycle basis due to increasing complexity in the era of IoT + AI.

- We believe Applied’s equipment business can continue to outperform the market as major roadmap inflections demand more of our materials engineering technologies.

- And we expect our services business to grow as fast or faster than our equipment business as its revenue steadily compounds with the growth of our installed base, which is the largest in the industry.

In upcoming blog posts, I will dive deeper into this framework for understanding the evolution of the WFE market, including a look back at the factors that drove the inflection in 2015 and a look ahead at how the new IoT + AI era is driving a shift to more materials-enabled scaling. This framework informs our company strategy for outperforming the markets, as we continue to deploy our unique materials engineering breadth and depth to be the most enabling technology partner to our customers.

Sundeep Bajikar

Corporate Vice President, Corporate Strategy and Marketing

Sundeep is Head of Corporate Strategy and Marketing (CSM) and guides the executive leadership team in the development of the company's growth thesis, strategic priorities, key initiatives and investor communications. He is also responsible for developing Applied’s marketing capabilities and community. Sundeep’s work served as the foundation for Applied’s strategies related to AI, ICAPS, Heterogenous Integration and Net Zero.

He joined Applied in 2017 after spending ten years as a Senior Equity Research Analyst covering global technology stocks, including Apple and Samsung Electronics, for Morgan Stanley and Jefferies. Previously he worked for a decade as a researcher, ASIC design engineer, system architect and strategic planning manager at Intel Corporation.

Sundeep holds an MBA in finance from The Wharton School and M.S. degrees in electrical engineering and mechanical engineering from the University of Minnesota. He holds 13 U.S. and international patents with more than 30 additional patents pending. Sundeep is also author of a book titled, “Equity Research for the Technology Investor – Value Investing in Technology Stocks.” He was an Institutional Investor Rising Star.

How to Think About Rising WFE Intensity

WFE intensity increases primarily for two reasons: capacity and complexity. 1) Semiconductor fabs need more equipment to increase capacity so they can process more wafers and meet increasing demand for semiconductors. Conventional thinking is that capacity is the primary driver of WFE intensity. 2) Manufacturers add more wafer processing steps to produce more complex circuitry at higher levels of integration, thereby enabling more capable chips at a lower cost per function.

A New Normal for Semiconductor Growth?

Our analysis suggests semiconductor industry revenue growth inflected from a low-to-mid-single-digit CAGR in the 2000-2015 period to a mid-to-high-single-digit CAGR in the 2015-2021 period (see Chart 1). Based on our Battle of Exponentials framework and proprietary semiconductor industry model, we wouldn’t be surprised if semiconductor revenues continue to grow at this higher rate for the foreseeable future.

Battle of Exponentials — A Different Way to Think About Accelerating Semiconductor Growth

Recent increases in semiconductor growth may be explained by an ongoing battle between two exponentials: 1) the upward-sloping growth of data generation, which drives semiconductor unit demand, and 2) the downward sloping reduction in transistor costs driven by classic 2D Moore’s Law scaling, which drives ASP reductions.