Products & Technologies

Back to Menu

Products & Technologies

Services

Resources

Posted

January 21, 2022

Stay updated on our content.

A New Normal for Semiconductor Growth?

Jan 21, 2022

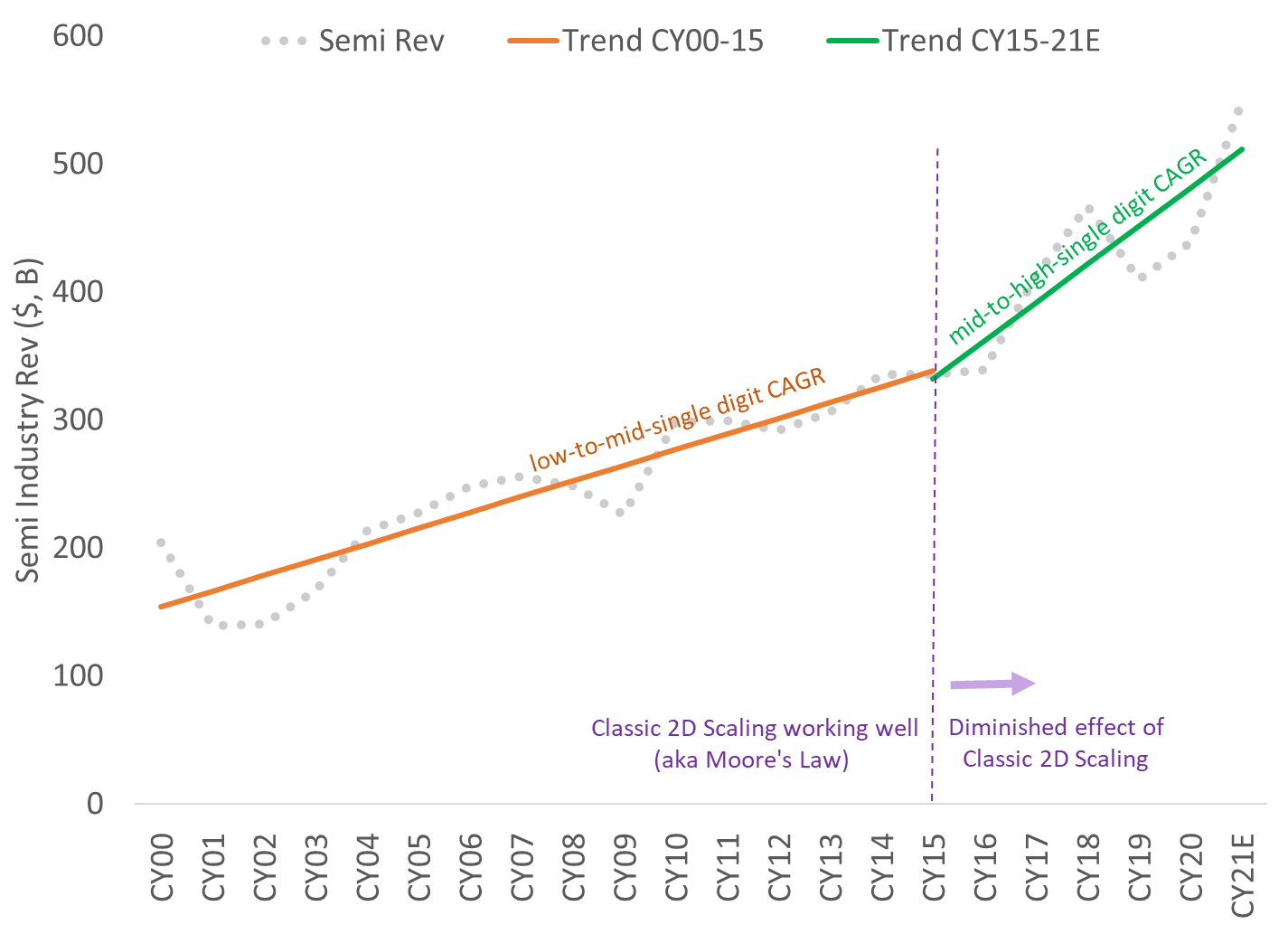

Our analysis suggests semiconductor industry revenue growth inflected from a low-to-mid-single-digit CAGR in the 2000-2015 period to a mid-to-high-single-digit CAGR in the 2015-2021 period (see Chart 1). Based on our Battle of Exponentials framework and proprietary semiconductor industry model, we wouldn’t be surprised if semiconductor revenues continue to grow at this higher rate for the foreseeable future.

Chart 1: Inflection in Semiconductor Trend Line Revenue Growth Rate.

Source: SIA, SEMI, TechInsights (VLSIresearch), Applied Materials - Strategy & Market Intelligence.

Memory Growth Accelerated by 900 bps, Foundry/Logic Growth Accelerated by 400 bps

We estimate memory (DRAM + NAND) revenues represented ~30% of total semiconductor revenues in CY21. Our analysis suggests the memory revenue CAGR stepped up to 13% in the 2015-2021 period from 4% in the 2000-2015 period. We estimate the Foundry/Logic (~70% of semiconductor revenue in CY21) revenue CAGR stepped up to 7% from 3%.

2015 Was an Inflection Year

Our Battle of Exponentials framework assumes 2015 was an inflection year when traditional Moore’s Law (a.k.a. classic 2D scaling) stopped working well. In around 2012, memory companies started describing a deceleration of unit cost reductions in DRAM. The NAND industry started its transition from planar to 3D NAND in 2013. In around 2014, the Foundry industry transition toward “inter nodes” and “plus nodes” started in principle with competitive debate about 16nm vs. 14nm offerings.

Note on Our Semiconductor Industry Model

Our proprietary model is based on aggregating semiconductor-related revenues for 80+ individual companies to approximate the Semiconductor Industry Association’s aggregate revenue estimates. This approach allows us to segment revenues by device type (i.e. DRAM, NAND and Foundry/Logic), and further segment Foundry/Logic revenues by leading-edge and non-leading-edge “ICAPS” nodes that principally serve the IoT, Communications, Automotive, Power and Sensor markets. Given the cyclicality of revenues, especially in memory, we decided that using CAGRs provides the most meaningful comparisons across the periods of interest on a through-cycle basis.

In the next blog post I’ll share some data to help translate semiconductor revenue growth into wafer fab equipment (WFE) spending growth.

Tags: Moore's Law, Exponential, DRAM, NAND, Foundry, logic, WFE

Sundeep Bajikar

Corporate Vice President, Corporate Strategy and Marketing

Sundeep is Head of Corporate Strategy and Marketing (CSM) and guides the executive leadership team in the development of the company's growth thesis, strategic priorities, key initiatives and investor communications. He is also responsible for developing Applied’s marketing capabilities and community. Sundeep’s work served as the foundation for Applied’s strategies related to AI, ICAPS, Heterogenous Integration and Net Zero.

He joined Applied in 2017 after spending ten years as a Senior Equity Research Analyst covering global technology stocks, including Apple and Samsung Electronics, for Morgan Stanley and Jefferies. Previously he worked for a decade as a researcher, ASIC design engineer, system architect and strategic planning manager at Intel Corporation.

Sundeep holds an MBA in finance from The Wharton School and M.S. degrees in electrical engineering and mechanical engineering from the University of Minnesota. He holds 13 U.S. and international patents with more than 30 additional patents pending. Sundeep is also author of a book titled, “Equity Research for the Technology Investor – Value Investing in Technology Stocks.” He was an Institutional Investor Rising Star.

How to Think About Rising WFE Intensity

After declining significantly from a peak in 2000, wafer fab equipment (WFE) intensity has been on an uptrend in recent years. As a result, semiconductor equipment revenue growth has been outpacing semiconductor growth.

Battle of Exponentials — A Different Way to Think About Accelerating Semiconductor Growth

Semiconductor growth has accelerated to higher levels that may represent a new normal as suggested by our “battle of exponentials” framework.

Expanding the Ecosystem for Hybrid Bonding Technology

Applied Materials recently entered a new phase of our R&D collaboration with A*STAR’s Institute of Microelectronics to accelerate materials, equipment and process technology solutions for hybrid bonding and other emerging, 3D chip integration technologies.