TABLE OF CONTENTS

A Letter from Ali Salehpour - Many Roads to Accelerate Time to Market

Boost Factory Productivity Faster With Applied SmartFactory™ Dispatching And Reporting

Breaking The Cycle—MtM Technologies Push Forward

In The Age of AI, Maydan Technology Center Evolves

E-Beam Review and CD Measurement Revolutionizes Display Yield Management

Breaking the Cycle—More-than-Moore (MtM) Technologies Push Forward

By Nanochip Staff

Introduced in 1985, the ≤200mm silicon wafer generation has enjoyed longevity that is nothing short of amazing. More than Moore (MtM) devices such as MEMs sensors have expanded in variety and number, driven largely by smartphones. At the same time, new applications such as silicon carbide (SiC)-based power MOSFETs, gallium arsenide (GaAs)-based RF power devices and vertical cavity surface emitting lasers (VCSELs) are continuing to drive demand for ≤200mm manufacturers.

Yole Développement (Lyon, France) is predicting "extended strong growth" for MEMS and sensors. Eric Mounier, senior analyst at Yole, forecast that during 2018–2023, the MEMS market will experience 17.5% growth in value and 26.7% growth in units. The sensors and actuators market will exceed $100B in 2023, for a total of 185 billion units.

Eric Monier,

Yole Développement

Mike Rosa,

Applied Materials

Cody Harlow, Applied Materials

But while demand is strong, supply is tight for 200mm tools. The availability of used cores has largely dried up.

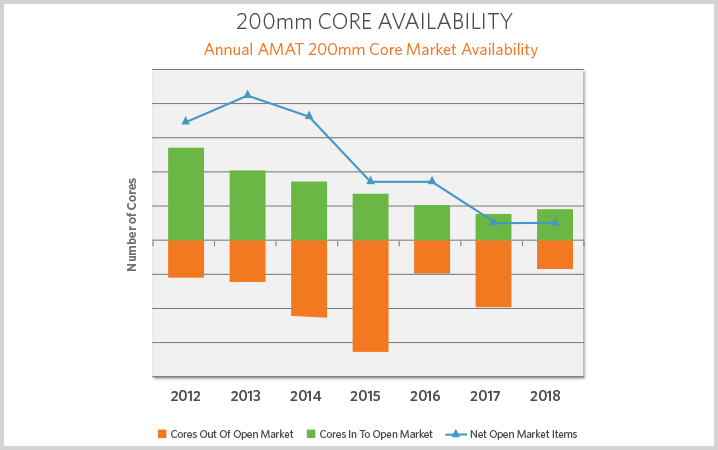

"Used cores are scarce. Back in 2015 there were hundreds of tools on the market, and now it is in the dozens," said Cody Harlow, senior director of operations at Applied Materials. "In 2015 there were probably 60 Endura PVD used tools on the market, but there might not even be one now. Prices for used 200mm tools are 4x or even 5x what we paid three years ago. I won’t say there are no cores, but there are limited numbers." (See figure 1.)

Figure 1. The number of used Applied Materials cores on the market has dropped sharply since 2015, and prices for those cores have increased by four times or more. (Source: Applied Materials)

Moreover, the quality and configuration of those available cores "is sometimes not what we need," Harlow said. Memory fabs normally don’t have epi or metal etch tools in their inventory, so those tool categories are not available for 200mm logic fabs. "There are gaps in the product offering."

Prices have gone up accordingly. "Some cores are well over a million dollars. Some have gone up 500%, and a large number have gone up 300%," Harlow said.

Emerald Greig, Surplus Global

Emerald Greig, executive vice president of Surplus Global (Phoenix, AZ), one of the industry’s largest secondary equipment suppliers, said more 200mm tools are coming on the market in the second half of 2018 compared with earlier in the year, as large chipmakers release used tools from their fabs and warehouses. And next year may be slightly better.

"There is some relief, but it is still not enough. We are in a period of continued high supply and demand imbalance. I still cannot meet the customers’ demands, and getting tools is very competitive," she said.

John Cummings,

Applied Materials

John Cummings, managing director at AGS, said while prices for used cores have tripled, or more, over the last few years, Applied has held the line on price increases for refurbished tools, absorbing the difference between the cost of the used cores and the price of the refurbished final product. "Our prices are up more than 50% in the last three years, on average, while over that same time frame the cores that we buy are up approximately three times."

What's Old Is New

The overall result has been a market flip. Cummings said that for several years a majority of Applied’s 200mm equipment sales came from refurbished tools. Now, a majority of 200mm sales start with a new mainframe, new chambers, and perhaps a small amount—10% or less—of used content.

In certain product categories, "not only can we not find a used core to refurbish, the customer may not want one. The new tools have a much better cost of ownership. Lots of customers want to buy a mostly new tool to get those new chambers," Cummings said.

In order to supply new 200mm tools, Applied has made efforts to revitalize the supply chain, taking steps to gain the attention of busy suppliers.

Obsolescence is another issue. "We started to see this problem seven or eight years ago," Harlow said, "but now it is across the board [in refurbishing]. We are making major investments in the supply chain, but in some cases options just do not exist. Who do you call? It is all about the supply base. We have to invest to bridge the gap. Sometimes, especially with chips or PCBs that are no longer being made, we just have to come up with our own solutions."

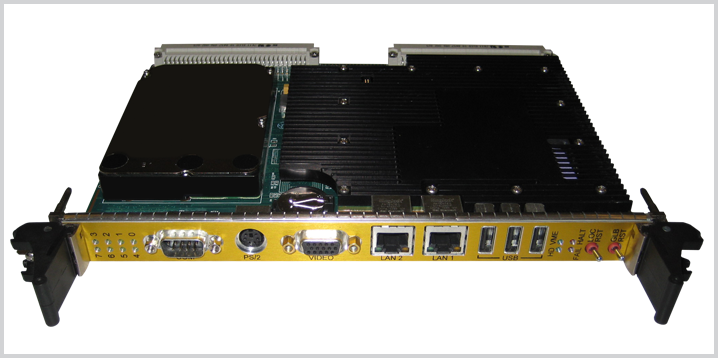

For refurbished tools, Harlow said that "there is often a productivity gain, like with the Applied Vita™ controller,” introduced by the company a few years ago to upgrade aging system control technology. “All tools that go out from Applied’s Austin manufacturing facility have [Vita] installed."

Applied began putting the more-powerful Vita controller on its Producer™ CVD tools, but that has expanded to include the company’s Centura™ CVD, Mirra™ CMP and ComPLUS™ wafer inspection product lines, and others. "Vita is now on almost everything we do," Cummings said.

All 200mm tools shipping from Applied’s Austin facility are upgraded with new Vita controllers.

Buying a new 200mm tool has productivity benefits too, because the company has continued to improve and update its existing technologies. The Pronto™ epi tool, for example, has a much higher growth rate than the original epi chamber, and Cummings said the overall throughput has gone up by 50% compared to the previous system. The situation is similar for the Endura™ PVD system, which provides high deposition rates for aluminum.

For some advanced More than Moore (MtM) applications, Applied offers technology originally developed for 300mm chambers in a 200mm configuration to enhance productivity and offer the latest technologies available, Rosa said. In etch, for example, by using a larger chamber a higher percentage of the 200mm wafer is in the “sweet spot” region with the best plasma uniformity, boosting yields.

Technology also flows both ways: from 200 up to 300mm tools and from 300mm tools into 200mm equipment.

In key MEMS and power areas, Applied has made process and materials advances for 200mm equipment that can be migrated to 300mm tools, "enabling a level of support not possible with competing OEMs," Rosa said. Examples include epi capabilities for power and MEMS; DRIE for power, MEMS, and TSVs; PVD for RF MEMS; and thick aluminum deposition for power ICs.

A Positive Outlook

However strong the market is now for 200mm equipment, there are limits imposed by the marketplace. Rosa noted that even with increased demand for certain devices, "customers are fighting a battle for market share. They have to hit the correct ASP to win that market share, fighting their own internal economics."

Cummings observed that Applied Materials faces its own set of competitors, including third-party refurbishers and other OEMs. "Customers have alternatives, so we always have to keep prices competitive and earn their business," he said, adding that the company’s deep roots in global markets and continuous investment in equipment and technology upgrades have provided competitive advantages, "particularly now that we are shipping mostly new 200mm tools."

Asked to describe the business situation for 200mm manufacturing, Cummings said, "Overall business has been very strong. We are not seeing any cooling off in More than Moore markets at all."

Cummings also said that Applied is hiring more people to support customer expansion in key regions globally. He noted that one mid-sized foundry recently considered building a 300mm fab then opted instead to expand capacity at its 200mm fab, while another major semiconductor vendor decided to add 100 thousand more 200mm wafer starts, pulling used cores out of its warehouses for refurbishment and putting out purchase orders for new 200mm tools.

"We are increasing our capacity [for new 200mm tools] every quarter. We will do it again in Q1," Harlow said.

In a June 2018 report, SEMI predicted that 200mm capacity was likely to grow 10% in the 2017–2022 period, adding approximately 600,000 wafer starts per month of 200mm capacity over the 5-year period.

Christian Dieseldorff, SEMI

In mid-October, SEMI Senior Market Analyst Christian Dieseldorff noted that since the June report, four more 200mm facilities have been added to the SEMI fab database. "The 200mm capacity could be stronger than 10%. More fabs are being built, and the total number of 200mm fabs could exceed the total number back in 2007," he said.

Dieseldorff pointed to growth in the industrial sector, which has "a huge demand" for devices made on 200mm wafers. As factories become more connected and intelligent, as power devices diversify, and as the Internet of things and automotive markets expand, there could be an undersupply of 200mm devices.

"I am hearing that there may not be enough 200mm capacity. Many devices have found their sweet spots, cost-wise, on 200mm wafers," he said, adding that most devices on smartphones are still made on 200mm or smaller wafers.

"One concern is the availability of the equipment. The used equipment market has dried up, and while new 200mm equipment is being manufactured, based on the latest standards, it is not cheaper. So the holdup may be that there is not enough equipment to fill up these 200mm fabs," Dieseldorff said.

Rosa predicts that by 2021 there will be 6 million wspm on 200mm wafers. That number will continue to grow as long as three-quarters of the chips in a smartphone, for example, remain on 200mm and 150mm substrates, and power ICs for electric vehicles turn to silicon carbide.

"We see a nearly double-digit percent growth for 200mm revenues. If you are looking where to invest, 200mm is attractive," Rosa said.

For additional information, contact mike_rosa@amat.com